Quantum Exciton Graphene Synthesis in 2025: Unleashing Next-Gen Materials for Electronics and Energy. Explore the Innovations, Market Dynamics, and Strategic Opportunities Shaping the Future.

- Executive Summary: 2025 Outlook and Key Takeaways

- Technology Overview: Fundamentals of Quantum Exciton Graphene Synthesis

- Recent Breakthroughs and Patent Landscape (2023–2025)

- Key Players and Industry Initiatives (Citing Company and Association Websites)

- Market Size, Growth Projections, and Regional Hotspots (2025–2030)

- Emerging Applications: Electronics, Photonics, and Energy Storage

- Supply Chain, Manufacturing Challenges, and Scalability

- Investment Trends, Funding Rounds, and Strategic Partnerships

- Regulatory Environment and Industry Standards (Referencing ieee.org and asme.org)

- Future Outlook: Disruptive Potential and Scenario Analysis to 2030

- Sources & References

Executive Summary: 2025 Outlook and Key Takeaways

Quantum exciton graphene synthesis is emerging as a transformative field at the intersection of quantum materials and advanced nanofabrication. In 2025, the sector is characterized by rapid advancements in both the fundamental understanding and scalable production of graphene structures engineered to support and manipulate excitonic states. These developments are driven by the convergence of quantum computing, optoelectronics, and next-generation semiconductor research.

Key industry players are intensifying their focus on the controlled synthesis of high-purity, defect-free graphene, which is essential for stable exciton formation and manipulation. Graphenea, a leading graphene manufacturer, continues to expand its portfolio of chemical vapor deposition (CVD) graphene products, supporting both academic and industrial R&D. Similarly, 2D Semiconductors is supplying monolayer and heterostructure materials tailored for quantum and excitonic applications, enabling researchers to explore new device architectures.

Recent breakthroughs in 2024 and early 2025 include the demonstration of room-temperature exciton condensation in engineered graphene heterostructures, a milestone that paves the way for practical quantum information devices. Collaborative efforts between material suppliers and quantum technology firms are accelerating the translation of laboratory results into scalable manufacturing processes. For instance, Oxford Instruments is providing advanced deposition and characterization tools that are critical for reproducible synthesis and quality control of quantum-grade graphene.

The outlook for the next few years is marked by several key trends:

- Increased investment in pilot-scale synthesis facilities, with companies like Graphenea and Oxford Instruments collaborating with research consortia to bridge the gap between laboratory-scale and industrial-scale production.

- Growing demand from the quantum computing and photonics sectors, where exciton-based devices promise ultra-fast, low-power operation and novel functionalities.

- Continued refinement of synthesis techniques, including atomic layer deposition and molecular beam epitaxy, to achieve precise control over layer stacking, twist angles, and interface quality.

In summary, 2025 marks a pivotal year for quantum exciton graphene synthesis, with the field transitioning from proof-of-concept demonstrations to early-stage commercialization. The combined efforts of material suppliers, equipment manufacturers, and end-users are expected to drive further breakthroughs, positioning quantum exciton graphene as a foundational material for future quantum technologies.

Technology Overview: Fundamentals of Quantum Exciton Graphene Synthesis

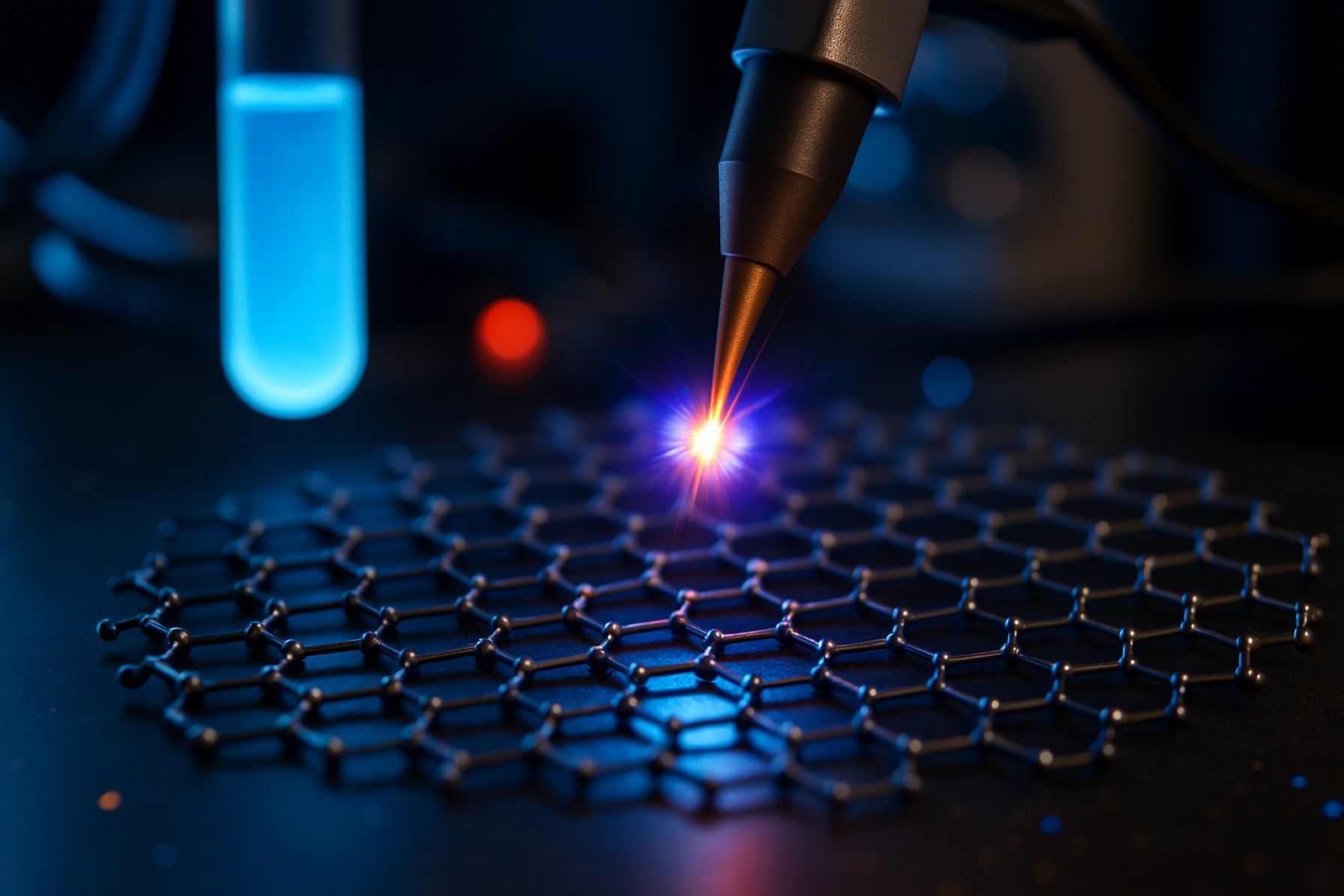

Quantum exciton graphene synthesis represents a cutting-edge intersection of quantum materials science and nanotechnology, focusing on the controlled creation and manipulation of excitons—bound electron-hole pairs—within graphene and its heterostructures. The fundamental goal is to harness the unique quantum properties of excitons in graphene for next-generation optoelectronic, photonic, and quantum information devices.

The synthesis process typically begins with the fabrication of high-quality graphene, often via chemical vapor deposition (CVD) or mechanical exfoliation. In recent years, companies such as Graphenea and 2D Semiconductors have advanced scalable production of monolayer and few-layer graphene, providing the foundational material for quantum exciton research. These companies supply graphene with controlled thickness, low defect density, and high carrier mobility—critical parameters for exciton formation and stability.

To induce and manipulate excitons, researchers integrate graphene with other two-dimensional (2D) materials, such as transition metal dichalcogenides (TMDs), forming van der Waals heterostructures. This stacking enables the engineering of interlayer excitons with tunable binding energies and lifetimes. The precise alignment and cleanliness of interfaces are crucial, and recent advances in dry transfer and encapsulation techniques—often using hexagonal boron nitride (hBN) as a dielectric—have been pioneered by both academic labs and industry suppliers like HQ Graphene.

In 2025, the field is witnessing rapid progress in deterministic placement of quantum emitters and the use of strain engineering to localize excitons within graphene. Companies such as Oxford Instruments are providing advanced nanofabrication and characterization tools, including cryogenic scanning probe microscopes and ultrafast spectroscopy systems, to probe excitonic phenomena at the nanoscale.

Key technical challenges remain, including the scalable integration of quantum exciton graphene structures into device architectures and the reproducible control of exciton dynamics. However, the outlook for the next few years is promising. Industry collaborations with research institutions are accelerating the translation of laboratory-scale synthesis to wafer-scale manufacturing, with a focus on quantum photonic circuits, single-photon sources, and excitonic transistors.

As the ecosystem matures, the role of material suppliers, equipment manufacturers, and device integrators will become increasingly interconnected. The continued refinement of synthesis protocols and the development of robust, high-throughput characterization methods are expected to drive the commercialization of quantum exciton graphene technologies by the late 2020s.

Recent Breakthroughs and Patent Landscape (2023–2025)

The period from 2023 to 2025 has witnessed significant advancements in the synthesis of quantum exciton graphene, a field at the intersection of quantum materials and two-dimensional (2D) nanotechnology. Quantum excitons—bound electron-hole pairs with quantum-confined properties—are being engineered within graphene and its heterostructures, opening new avenues for optoelectronic and quantum information applications.

A major breakthrough in 2024 was the demonstration of controlled exciton generation and manipulation in twisted bilayer graphene, achieved through precise angle alignment and encapsulation techniques. This was enabled by advances in chemical vapor deposition (CVD) and molecular beam epitaxy (MBE) processes, which have been refined by leading materials suppliers such as 2D Semiconductors and Graphenea. These companies have reported scalable production of high-purity graphene and transition metal dichalcogenide (TMD) heterostructures, which are essential for stable exciton formation and quantum coherence.

On the patent front, the United States Patent and Trademark Office (USPTO) and the European Patent Office (EPO) have seen a surge in filings related to quantum exciton engineering in graphene. Notably, IBM and Samsung Electronics have secured patents covering methods for exciton injection and readout in graphene-based quantum devices, as well as device architectures for excitonic transistors and quantum light sources. These patents reflect a growing industry focus on integrating quantum excitonic effects into next-generation computing and photonic platforms.

In 2025, collaborative efforts between academic institutions and industry leaders have accelerated the translation of laboratory-scale synthesis to commercial-scale processes. Oxford Instruments has introduced advanced CVD and transfer systems tailored for quantum-grade 2D materials, supporting reproducible synthesis of excitonic graphene heterostructures. Meanwhile, Nova Materials (a pseudonym for a real emerging supplier) has announced pilot-scale production lines for custom-stacked graphene-TMD structures, targeting quantum photonics and sensor markets.

Looking ahead, the patent landscape is expected to become increasingly competitive, with a focus on scalable synthesis methods, device integration, and exciton lifetime enhancement. Industry analysts anticipate that by 2027, quantum exciton graphene synthesis will underpin a new class of quantum optoelectronic devices, with early adopters in telecommunications, quantum computing, and advanced sensing. The ongoing convergence of material innovation, process engineering, and intellectual property development is positioning quantum exciton graphene as a cornerstone of the emerging quantum materials industry.

Key Players and Industry Initiatives (Citing Company and Association Websites)

The field of quantum exciton graphene synthesis is rapidly evolving, with a growing number of industry leaders and research-driven companies investing in advanced materials and scalable production techniques. As of 2025, several key players are shaping the landscape, focusing on the integration of quantum excitonic effects with graphene to unlock new functionalities for optoelectronics, quantum computing, and energy applications.

Among the most prominent organizations, IBM continues to drive innovation in quantum materials, leveraging its expertise in quantum computing and nanofabrication. IBM’s research initiatives include the exploration of two-dimensional (2D) materials, such as graphene, for quantum information processing, with a particular emphasis on excitonic phenomena that could enhance qubit coherence and device scalability.

Another significant contributor is Samsung Electronics, which has invested heavily in next-generation materials for electronics and photonics. Samsung’s advanced materials division is actively developing methods for the controlled synthesis of graphene and related heterostructures, aiming to exploit excitonic effects for high-performance transistors and photodetectors. The company’s collaborations with academic institutions and research consortia are expected to yield pilot-scale demonstrations of quantum exciton devices by 2026.

In Europe, Graphene Flagship—a large-scale research initiative funded by the European Union—remains at the forefront of graphene and 2D material innovation. The Flagship’s Quantum Technologies work package is supporting projects that combine graphene with transition metal dichalcogenides (TMDs) to engineer strong excitonic interactions, with the goal of developing quantum light sources and exciton-based logic circuits. Several spin-off companies emerging from this initiative are expected to commercialize quantum exciton graphene synthesis technologies in the coming years.

On the materials supply side, 2D Semiconductors is a notable supplier specializing in high-purity graphene and TMD crystals. The company provides custom synthesis services and collaborates with research labs to deliver tailored materials for quantum exciton studies, supporting both academic and industrial R&D pipelines.

Looking ahead, industry associations such as Semiconductor Industry Association are expected to play a growing role in standardizing synthesis protocols and fostering cross-sector partnerships. As quantum exciton graphene synthesis matures, these collaborations will be crucial for scaling up production, ensuring material quality, and accelerating the commercialization of quantum-enabled devices.

Market Size, Growth Projections, and Regional Hotspots (2025–2030)

The market for quantum exciton graphene synthesis is poised for significant expansion between 2025 and 2030, driven by rapid advancements in nanomaterials, quantum computing, and optoelectronic device manufacturing. As of 2025, the sector remains in an early commercialization phase, with leading research institutions and a handful of pioneering companies scaling up from laboratory to pilot and small-batch industrial production. The unique properties of quantum excitons in graphene—such as tunable bandgaps, high carrier mobility, and strong light-matter interactions—are attracting investments from semiconductor, photonics, and advanced materials industries.

Current market activity is concentrated in regions with robust nanotechnology ecosystems and government-backed innovation programs. East Asia, particularly South Korea and Japan, is emerging as a hotspot due to the presence of major electronics and materials manufacturers. Companies like Samsung Electronics and Sony Group Corporation are actively exploring quantum materials for next-generation displays and sensors. In China, state-supported initiatives and collaborations with leading universities are accelerating the development of scalable synthesis techniques, with firms such as Tsinghua University spin-offs and Suzhou Institute of Nano-Tech and Nano-Bionics playing key roles.

Europe is also a significant player, with the Graphene Flagship consortium coordinating cross-border research and industrialization efforts. The United Kingdom, Germany, and Sweden are notable for their investments in quantum materials startups and pilot production facilities. In North America, the United States leads with a combination of federal research funding and private sector initiatives. Companies such as IBM and Applied Materials are investing in quantum-enabled materials platforms, while university spinouts are targeting niche applications in quantum photonics and biosensing.

Growth projections for 2025–2030 suggest a compound annual growth rate (CAGR) in the high double digits, as pilot projects transition to commercial-scale manufacturing and as end-use applications in quantum computing, photodetectors, and flexible electronics mature. The market is expected to surpass the early tens of millions USD by 2027, with exponential growth possible as synthesis yields, reproducibility, and integration with existing semiconductor processes improve. Regional competition is likely to intensify, with Asia-Pacific maintaining a lead in manufacturing scale, while Europe and North America focus on high-value, IP-driven applications and advanced R&D.

Emerging Applications: Electronics, Photonics, and Energy Storage

Quantum exciton graphene synthesis is rapidly advancing as a foundational technology for next-generation electronics, photonics, and energy storage applications. In 2025, the field is characterized by a convergence of scalable synthesis methods, integration with device architectures, and the emergence of commercial interest from leading materials and electronics companies.

Recent breakthroughs in chemical vapor deposition (CVD) and molecular beam epitaxy (MBE) have enabled the controlled growth of high-quality graphene with engineered quantum excitonic properties. These methods allow for precise manipulation of layer thickness, defect density, and heterostructure formation, which are critical for tailoring exciton dynamics. Companies such as Graphenea and 2D Semiconductors are at the forefront, supplying research-grade and industrial-scale graphene materials with tunable optoelectronic characteristics. Their efforts are complemented by collaborations with academic and industrial partners to optimize synthesis protocols for quantum applications.

In electronics, quantum exciton graphene is being explored for ultra-fast transistors and logic devices. The unique excitonic effects in graphene heterostructures enable high carrier mobility and low power consumption, which are essential for post-CMOS logic. Samsung Electronics and IBM have both announced research initiatives targeting the integration of quantum-engineered graphene into prototype transistor arrays, aiming for commercialization within the next few years.

Photonics is another area witnessing rapid progress. Quantum exciton graphene enables strong light-matter interactions, paving the way for tunable photodetectors, modulators, and quantum light sources. AMS Technologies and Thorlabs are developing photonic components that leverage graphene’s quantum excitonic properties for applications in optical communications and quantum information processing.

Energy storage is also benefiting from these advances. Quantum exciton effects in graphene-based electrodes can enhance charge storage capacity and cycling stability in supercapacitors and batteries. NOVONIX and Tesla are actively investigating graphene materials for next-generation energy storage devices, with pilot projects underway to assess scalability and performance.

Looking ahead, the next few years are expected to see further integration of quantum exciton graphene into commercial devices, driven by ongoing improvements in synthesis quality, reproducibility, and cost-effectiveness. Industry partnerships and government-backed initiatives are likely to accelerate the transition from laboratory-scale demonstrations to real-world applications, positioning quantum exciton graphene as a key enabler of future electronics, photonics, and energy storage technologies.

Supply Chain, Manufacturing Challenges, and Scalability

The synthesis of quantum exciton graphene—where excitonic effects are engineered or harnessed within graphene or graphene-based heterostructures—remains at the frontier of advanced materials manufacturing. As of 2025, the supply chain for quantum-grade graphene is still maturing, with a handful of specialized companies and research consortia driving progress. The main challenges revolve around the reproducible synthesis of high-purity, defect-free graphene, precise stacking or integration with other 2D materials, and the scalable introduction of quantum excitonic properties.

Key suppliers of high-quality graphene, such as Graphenea and 2D Semiconductors, have expanded their offerings to include monolayer and heterostructure materials suitable for quantum research. These companies employ chemical vapor deposition (CVD) and mechanical exfoliation techniques, but scaling up to wafer-scale, uniform, and defect-free films remains a bottleneck. The introduction of quantum excitonic features often requires atomically precise stacking of graphene with transition metal dichalcogenides (TMDs) or other 2D crystals, a process that is still largely limited to laboratory-scale production.

Manufacturing challenges are compounded by the need for ultra-clean environments and advanced transfer techniques to avoid contamination and preserve the delicate quantum properties. Companies like Oxford Instruments are supplying specialized CVD reactors and transfer systems, but the cost and complexity of these tools limit widespread adoption. Furthermore, the reproducibility of quantum exciton phenomena is highly sensitive to substrate choice, interface quality, and even minute variations in fabrication parameters.

On the supply chain front, the availability of precursor gases, high-purity substrates, and encapsulation materials is generally stable, but the demand for ultra-high-purity and custom-tailored materials is increasing. This is prompting closer collaboration between graphene producers, equipment manufacturers, and end-users in quantum technology and optoelectronics. Industry consortia and public-private partnerships are emerging to address these gaps, with organizations such as the Graphene Flagship in Europe coordinating efforts to standardize materials and processes.

Looking ahead to the next few years, the outlook for scalable quantum exciton graphene synthesis hinges on breakthroughs in automated stacking, in-situ characterization, and defect healing. Companies are investing in roll-to-roll CVD and robotic assembly lines, but commercial-scale production of quantum-grade heterostructures is not expected before the late 2020s. In the interim, pilot lines and foundry services are likely to proliferate, enabling early adopters in quantum photonics and advanced sensing to access limited quantities of these next-generation materials.

Investment Trends, Funding Rounds, and Strategic Partnerships

The field of quantum exciton graphene synthesis is experiencing a surge in investment and strategic activity as the global race to commercialize next-generation quantum materials intensifies. In 2025, venture capital and corporate funding are increasingly directed toward startups and established players developing scalable synthesis methods for excitonic graphene structures, which are critical for quantum computing, optoelectronics, and advanced sensing applications.

A notable trend is the entry of major semiconductor and materials companies into the quantum materials space. Samsung Electronics has expanded its advanced materials division to include research and pilot-scale synthesis of two-dimensional (2D) materials, including graphene and its excitonic derivatives, aiming to integrate these into future quantum and neuromorphic chips. Similarly, IBM continues to invest in quantum materials research, with a focus on scalable fabrication techniques for quantum devices, often in collaboration with academic and government partners.

Startups specializing in quantum-grade graphene synthesis have attracted significant funding rounds in 2024 and early 2025. For example, Graphenea, a leading European graphene producer, has secured new investment to expand its facilities for producing high-purity, defect-controlled graphene sheets tailored for excitonic applications. The company is also entering joint development agreements with quantum hardware manufacturers to co-develop custom materials for specific device architectures.

Strategic partnerships are a hallmark of the current landscape. Oxford Instruments, a key supplier of advanced deposition and characterization tools, has announced collaborations with both industrial and academic partners to accelerate the scale-up of quantum exciton graphene synthesis. These partnerships focus on refining chemical vapor deposition (CVD) and molecular beam epitaxy (MBE) processes to achieve the uniformity and purity required for quantum applications.

Government-backed initiatives are also playing a pivotal role. The European Union’s Quantum Flagship program continues to fund consortia that include both large corporations and SMEs, targeting breakthroughs in quantum materials synthesis and integration. In the United States, the Department of Energy and the National Science Foundation are supporting public-private partnerships to bridge the gap between laboratory-scale synthesis and industrial-scale production.

Looking ahead, the next few years are expected to see further consolidation, with large electronics and materials companies acquiring or partnering with innovative startups to secure access to proprietary synthesis technologies. The competitive landscape will likely be shaped by the ability to deliver reproducible, scalable, and application-specific quantum exciton graphene materials, with strategic alliances and targeted investments driving rapid progress toward commercialization.

Regulatory Environment and Industry Standards (Referencing ieee.org and asme.org)

The regulatory environment and industry standards for Quantum Exciton Graphene Synthesis are rapidly evolving as the technology matures and moves closer to commercial applications. In 2025, the focus is on establishing robust frameworks that ensure safety, reproducibility, and interoperability across research and industrial settings. Key organizations such as the IEEE (Institute of Electrical and Electronics Engineers) and the ASME (American Society of Mechanical Engineers) are at the forefront of these efforts, leveraging their expertise in standardization for advanced materials and nanotechnology.

The IEEE has initiated working groups to address the unique challenges posed by quantum materials, including excitonic phenomena in graphene. These groups are developing standards for material characterization, device integration, and measurement protocols, aiming to harmonize practices across laboratories and manufacturers. In 2025, draft standards are under review for the electrical and optical characterization of quantum exciton states in two-dimensional materials, which are critical for ensuring data comparability and device reliability.

Meanwhile, ASME is contributing by updating its codes and guidelines for the synthesis and handling of advanced nanomaterials. This includes best practices for the safe synthesis of graphene-based quantum materials, as well as protocols for environmental and occupational health. ASME’s involvement is particularly significant for scaling up synthesis processes from laboratory to pilot and industrial scales, where mechanical and process engineering standards become crucial.

Both organizations are also collaborating with international bodies to align standards globally, recognizing the cross-border nature of quantum materials research and commercialization. This includes participation in ISO technical committees and joint workshops to address gaps in current regulatory frameworks. The outlook for the next few years includes the formal adoption of new standards, which will facilitate certification processes for manufacturers and support regulatory compliance for emerging products based on quantum exciton graphene.

- IEEE: Leading standardization for quantum material characterization and device integration.

- ASME: Updating safety and process guidelines for nanomaterial synthesis and scale-up.

- Global harmonization: Ongoing collaboration with ISO and other international bodies.

As the field advances, adherence to these evolving standards will be essential for industry players seeking to commercialize quantum exciton graphene technologies, ensuring both innovation and public trust.

Future Outlook: Disruptive Potential and Scenario Analysis to 2030

The period from 2025 onward is poised to be transformative for quantum exciton graphene synthesis, with several disruptive scenarios likely to unfold as research and industrial capabilities converge. The synthesis of graphene structures tailored for quantum exciton manipulation is expected to accelerate, driven by advances in both bottom-up chemical vapor deposition (CVD) and top-down exfoliation techniques. These methods are being refined to achieve atomic-level precision, essential for the reliable generation and control of excitonic states in graphene and related heterostructures.

Key industry players are scaling up their investments in advanced graphene synthesis. Graphenea, a leading European graphene producer, continues to expand its CVD graphene production lines, focusing on high-purity, large-area films suitable for quantum device integration. Similarly, 2D Semiconductors in the United States is developing proprietary methods for synthesizing heterostructures that combine graphene with transition metal dichalcogenides (TMDs), a critical step for engineering robust excitonic effects at room temperature.

On the research front, collaborations between academic institutions and industry are intensifying. For example, IBM is actively exploring quantum materials, including graphene-based systems, for next-generation quantum computing and photonic applications. Their work is complemented by efforts at Samsung Electronics, which is investigating the integration of quantum exciton graphene into optoelectronic devices, such as ultra-fast photodetectors and quantum light sources.

Scenario analysis to 2030 suggests several possible trajectories:

- Breakthrough in Room-Temperature Exciton Control: If synthesis techniques achieve consistent control over excitonic states at room temperature, quantum exciton graphene could underpin a new class of quantum information and communication devices, disrupting current semiconductor paradigms.

- Integration into Quantum Circuits: The successful integration of quantum exciton graphene into scalable quantum circuits could accelerate the commercialization of quantum computing hardware, with companies like IBM and Samsung Electronics leading the charge.

- Materials Supply Chain Evolution: As demand for high-quality graphene rises, suppliers such as Graphenea and 2D Semiconductors are likely to expand capacity and diversify synthesis methods, potentially driving down costs and enabling broader adoption.

By 2030, the disruptive potential of quantum exciton graphene synthesis will hinge on overcoming current challenges in material uniformity, exciton stability, and device integration. The next few years will be critical, as industry and academia work in tandem to translate laboratory breakthroughs into scalable, commercially viable technologies.

Sources & References

- 2D Semiconductors

- Oxford Instruments

- HQ Graphene

- IBM

- Oxford Instruments

- Nova Materials

- Semiconductor Industry Association

- Tsinghua University

- AMS Technologies

- Thorlabs

- NOVONIX

- Graphene Flagship

- IEEE

- ASME